Proactive tax planning helps individuals, families, and business owners secure savings in 2025. High-impact strategies allow taxpayers to maximize benefits through early action and year-end strategic moves. Tax strategies and Q3 optimization for 2025 encourage people to focus on both immediate and future financial advantages.

Key Takeaways

Maximize contributions to retirement accounts like 401(k)s and IRAs to take advantage of increased limits for 2025. This helps secure more savings for the future.

Use year-end strategies such as accelerating deductions and deferring income to lower your tax bill. Planning these actions can lead to significant savings.

Consider tax-loss harvesting to offset gains and improve after-tax returns. This strategy can help you keep more of your investment profits.

Maximize Retirement and Tax-Deferred Accounts

401(k) and IRA Contribution Tips

Retirement accounts offer powerful tax strategies for individuals and families. They can increase savings by maximizing contributions to 401(k) and IRA accounts. The IRS raised contribution limits for 2025, allowing workers to save more for retirement. The following table shows the updated limits compared to 2024:

| 401(k) Contribution Limits | 2024 | 2025 |

|---|---|---|

| Pre-tax & Roth Employee Contributions | $23,000 | $23,500 |

| Employee + Employer Contributions | $69,000 | $70,000 |

| Additional Catch-up Contributions (Ages 50+) | $7,500 | $7,500 |

| IRA Contribution Limits | 2024 | 2025 |

| Total Contribution (Under 50) | $7,000 | $7,000 |

| Total Contribution (Ages 50+) | $8,000 | $8,000 |

Workers age 50 and older can use catch-up contributions to boost retirement savings. They should review their payroll settings to ensure maximum contributions. Early planning helps them take full advantage of these tax strategies before year-end.

Roth Conversions for 2025

Roth conversions provide unique opportunities for taxpayers who expect higher future tax rates. They can convert traditional IRA funds to a Roth IRA and pay taxes at today’s rates. The benefits include:

Paying taxes now at a lower rate, which helps those who anticipate higher rates later.

Allowing the converted amount to grow tax-free, which increases long-term wealth.

Making withdrawals in retirement tax-free, which protects savings if tax rates rise.

Tax strategies like Roth conversions can create significant financial advantages. Individuals should evaluate their current and future tax brackets before making decisions. Consulting a financial advisor ensures they choose the best approach for their situation.

Use Year-End Tax Strategies for 2025 Tax Bill

Accelerate Deductions, Defer Income

Taxpayers can lower their 2025 tax bill by using year-end tax strategies that focus on timing. Accelerating deductions means paying deductible expenses before the year ends. Deferring income involves postponing payments or bonuses to the next year. These actions help manage taxable income and can reduce overall tax liability.

Taxpayers often make larger contributions to donor-advised funds in high-income years to maximize deductions. They also increase retirement plan contributions to optimize tax benefits. Matching ordinary deductions with higher income can further improve results.

| Strategy | Description |

|---|---|

| Accelerating deductions | Reduces taxable income in the current year, potentially lowering tax liability. |

| Deferring income | Allows taxpayers to postpone income recognition, which can be beneficial if expecting a higher tax bracket in the future. |

In 2025, the new limitation on itemized deductions will not apply. Taxpayers have a unique chance to preserve their itemized deductions by accelerating deductible expenses into this year.

Bunching and Timing Major Expenses

Bunching deductions means grouping deductible expenses into one year to exceed the standard deduction. Timing major expenses, such as charitable donations or medical bills, can help maximize tax savings. Taxpayers often bunch donations before the year ends or use donor-advised funds for greater impact.

| Deductible Expense | Description |

|---|---|

| Increased Standard Deduction | For 2025, the standard deduction is $31,500 for joint filers, $23,625 for heads of household, and $15,750 for singles. |

| Charitable Contributions | Bunching donations or using a donor-advised fund can optimize deductions before 2025 ends. |

| Car Loan Interest Deduction | Up to $10,000 in interest on loans for new personal-use vehicles can be deducted. Timing the purchase can maximize this benefit. |

Taxpayers who bunch deductions can see significant savings. For example, itemizing $40,000 in 2025 can save an estimated $6,560 over the standard deduction. Planning and timing expenses help individuals and families take full advantage of available tax breaks.

Tax Strategies and Q3 Optimization for 2025

Spreading Income and Deductions

Tax strategies and q3 optimization for 2025 help taxpayers manage their income and deductions across multiple years. They can avoid higher tax rates or the Alternative Minimum Tax (AMT) by spreading income. For example, a business owner may delay invoicing until January to move income into the next tax year. An employee might request a year-end bonus to be paid in the following year. Taxpayers can also accelerate deductible expenses, such as property taxes or mortgage interest, into 2025. This approach reduces taxable income for the current year and may prevent crossing into a higher tax bracket.

Tip: Tax strategies and q3 optimization for 2025 work best when taxpayers review projected income and deductions before year-end. They should use tax software or consult a professional to estimate their tax liability.

| Action | Benefit |

|---|---|

| Defer income | Avoid higher tax rates or AMT |

| Accelerate deductions | Lower taxable income for 2025 |

Shifting Income to Family Members

https://amzn.to/4qme5HB

Families can use tax strategies and q3 optimization for 2025 to shift income to members in lower tax brackets. Parents may gift appreciated assets to children, who then sell them at a lower tax rate. Business owners can pay reasonable wages to children for legitimate work. This technique reduces the family’s overall tax burden. The IRS sets rules for income shifting, so taxpayers must document transactions and ensure compliance.

Tax strategies and q3 optimization for 2025 encourage families to plan ahead. They should track income sources and consider the impact on each member’s tax situation. Early action leads to greater savings and fewer surprises at tax time.

Capital Gains and Investment Tax Planning

Tax-Loss Harvesting

Tax-loss harvesting helps investors reduce their tax bills by selling investments that have lost value. They use the losses to offset gains from other investments. This strategy works well for those with short-term capital gains, which face higher tax rates. Investors often see after-tax returns increase by 0.47% to 1.27% each year when they use tax-loss harvesting during favorable market conditions. They can also use bonus depreciation when investing in certain assets, which further lowers taxable income.

Investors should consider selling appreciated securities after holding them for more than 12 months. This approach allows them to benefit from lower long-term capital gains rates.

| Type of Gain | Tax Rate | Income Level |

|---|---|---|

| Short-Term Capital Gains | 10% – 37% | Varies by income bracket |

| Long-Term Capital Gains | 0% – 20% | Up to $533,400 for singles, $600,050 for couples |

Investors who harvest losses can offset short-term gains, which are taxed at higher rates. They may also use bonus depreciation to maximize deductions on eligible investments.

Tax-Efficient Investment Choices

Tax-efficient investment choices help investors keep more of their returns. Municipal bonds provide tax-exempt income, which benefits high-income investors. Many advisors recommend evergreen vehicles for private market exposure because they offer operational efficiency and liquidity. Strategies such as donating appreciated stock and loss harvesting can reduce tax liabilities over time.

Investors often use bonus depreciation when purchasing equipment or property for investment purposes. This deduction allows them to recover costs quickly and improve after-tax returns. They should review their portfolios regularly to identify opportunities for bonus depreciation and other tax-saving strategies.

Choosing the right investment vehicles and using bonus depreciation can lead to better financial outcomes in 2025.

Leverage Business and Self-Employed Deductions

https://amzn.to/4savPr9

Actual Expense Method

Business owners and self-employed individuals often look for ways to reduce taxable income. They can use the actual expense method or the standard mileage rate for vehicle deductions. The actual expense method allows them to deduct costs such as gas, maintenance, insurance, and depreciation. The standard mileage rate offers a simpler approach by multiplying business miles by a set rate.

Part-time drivers who track actual expenses may see a deduction of $4,850, while the standard mileage rate gives only $2,875. The actual expense method provides greater savings in this case.

Full-time drivers with higher expenses might receive a deduction of $10,912.5 using actual expenses, but the standard mileage rate could result in $11,500. For them, the standard mileage rate works better.

Self-employed individuals also benefit from other common deductions. The table below highlights two popular options:

| Deduction Type | Description |

|---|---|

| Home Office Deduction | Allows deduction of expenses related to the part of the home used exclusively for work. |

| Self-Employment Tax Deduction | Permits deduction of half of the self-employment tax, reducing taxable income. |

Timing Equipment and Major Purchases

Small businesses can maximize deductions by timing equipment and major purchases. IRS guidelines for 2025 encourage owners to plan purchases carefully.

Deduction limits for 2025 range from $1,230,000 to $1,240,000, with a phase-out threshold between $3,080,000 and $3,100,000.

Qualifying property includes tangible items such as equipment, machinery, vehicles over 6,000 lbs, computers, and office furniture.

Owners must file Form 4562 with their tax return to claim these deductions and report qualifying purchases.

Smart timing of purchases helps businesses lower taxable income and improve cash flow. Owners should review their needs before year-end to take full advantage of available deductions.

Maximize Credits and Charitable Giving

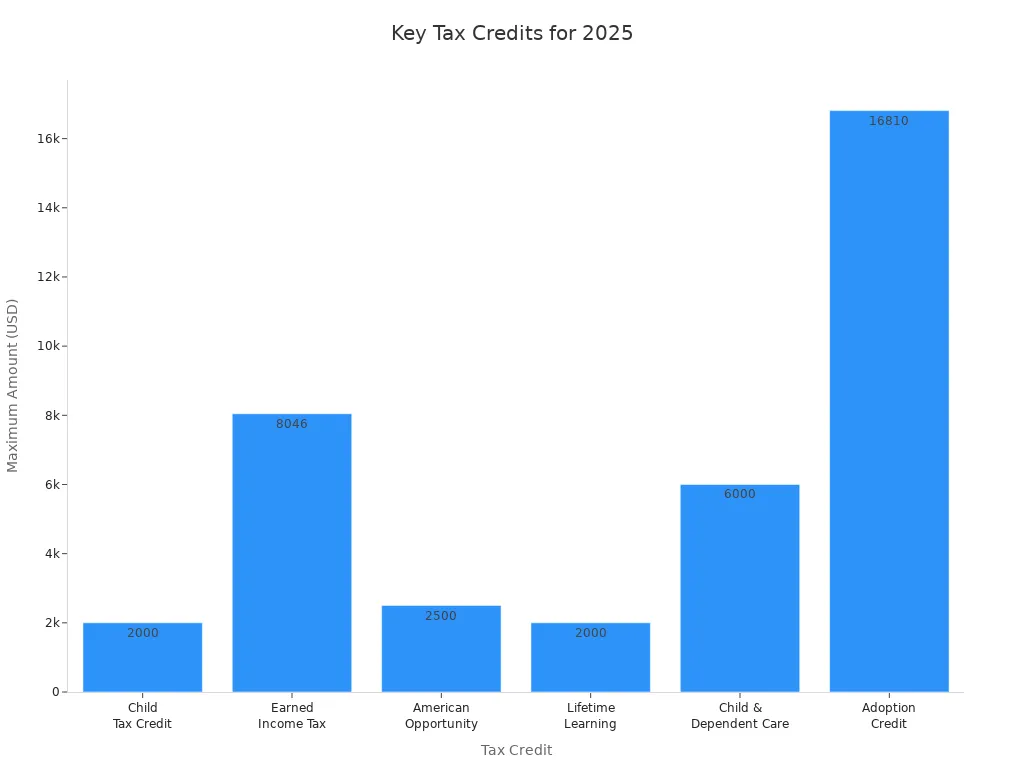

Key Tax Credits for 2025

Tax credits help individuals and families lower their tax bills directly. Several credits remain available in 2025, each with specific eligibility rules. The following table highlights the most important credits and their maximum values:

| Tax Credit | Description | Maximum Amount |

|---|---|---|

| Child Tax Credit | For qualifying children under 17. Income limits apply. | Up to $2,000 |

| Earned Income Tax Credit (EITC) | For low- to moderate-income workers and families. | Up to $8,046 |

| American Opportunity Tax Credit | For qualified education expenses in the first four years of higher education. | Up to $2,500 |

| Lifetime Learning Credit | For education expenses at any post-secondary level. | Up to $2,000 |

| Child and Dependent Care Credit | For work-related care expenses for qualifying individuals. | Up to $3,000 (1) / $6,000 (2+) |

| Adoption Credit | For qualified adoption expenses. | Up to $16,810 |

These credits can make a significant difference for taxpayers. For example, the Earned Income Tax Credit provides substantial support for working families. Education credits help offset the rising cost of college.

Charitable Contributions for Tax Savings

Charitable giving remains a powerful way to reduce taxable income in 2025. Taxpayers who itemize deductions can deduct cash donations to public charities up to 60% of their adjusted gross income (AGI). This rule allows for generous giving and greater tax savings.

Cash donations to public charities remain deductible up to 60% of AGI.

Taxpayers can deduct charitable contributions on a dollar-for-dollar basis when itemizing.

The deduction limits will change in 2026, so 2025 offers a unique opportunity for larger gifts.

Qualified charitable distributions (QCDs) from IRAs also provide tax benefits. Individuals aged 70½ or older can transfer up to $108,000 directly to a 501(c)(3) charity. The IRS requires Code Y in Box 7 of Form 1099-R for QCDs starting in 2025. QCDs must be completed by December 31 to count for the tax year.

Taxpayers should review their giving strategies before year-end to maximize both their impact and their tax savings.

Real Estate and Health Account Strategies

Real estate transactions play a major role in tax planning for 2025. Investors and homeowners can use several strategies to maximize savings. The following table highlights key options and planning considerations:

| Strategy | Description | Planning Considerations |

|---|---|---|

| Increased Bonus Depreciation | Restores bonus depreciation to 100% for property placed into service after January 19, 2025. | Conduct a cost segregation study to maximize depreciation in 2025. |

| Increased Low-Income Housing Credits | Permanently increases the low-income housing tax credit to 12% in 2026. | Leverage federal and state options to enhance ROI on projects. |

| Opportunity Zones | New program launching for 2027-2033 with stricter eligibility. | Reassess investment pipeline for qualifying zones. |

| Elimination of Energy Efficiency Credits | Credits for energy-efficient developments set to sunset after 2026. | Finalize qualifying developments before cutoff dates. |

| Permanent QBI Deduction | The 20% QBI deduction is now permanent with higher income thresholds. | Optimize entity structure to maximize QBI benefits. |

Homeowners benefit from deductions on state and local real estate taxes, capped at $10,000. Mortgage interest deductions also provide relief. Those who itemize can lower taxable income and reduce overall tax liability. Real estate transactions, such as buying or selling property, often trigger these deductions. Investors should review their portfolios and consider timing real estate transactions to take advantage of bonus depreciation and other credits.

Tip: Finalizing energy-efficient developments before the end of 2026 ensures eligibility for credits that will soon expire.

https://amzn.to/48UB5HS

HSA and FSA Contribution Tips

Health accounts offer valuable tax advantages for individuals and families. Contributing to Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) reduces taxable income and helps cover medical expenses. The 2025 contribution limits are as follows:

| Account Type | Contribution Limit |

|---|---|

| Health Care Flexible Spending Account (HCFSA) | $3,300 |

| 1. Health Savings Account (HSA) Self-only | $4,300 |

| 2. Health Savings Account (HSA) Family | $8,550 |

Individuals should maximize contributions early in the year. HSAs allow funds to roll over and grow tax-free, while FSAs require careful planning to avoid forfeiting unused balances. Those who expect high medical costs can benefit from increasing contributions. Real estate transactions sometimes affect health account planning, especially when moving for work or changing employment status.

Planning ahead with health accounts supports both immediate savings and long-term financial health.

Acting early with tax strategies helps taxpayers maximize savings for 2025. They benefit from tax-efficient investing, retirement-focused planning, and effective use of credits. Thoughtful planning minimizes taxes and protects assets. The table below shows how consistent annual tax planning supports long-term financial growth.

| Strategy | Benefit |

|---|---|

| Minimize overall tax liability | Reduces immediate tax burden, allowing for savings |

| Tailored tax planning solutions | Aligns with financial goals, enhances wealth growth |

Reviewing financial situations and consulting a tax professional ensures the best results. Proactive planning leads to greater savings and a smoother tax filing process.

https://pinardpublishing.com/what-are-the-benefits-and-drawbacks-of-ai-narrated-audiobooks/

FAQ

What is the best time to start tax planning for 2025?

Taxpayers should begin planning early in the year. Early action helps maximize deductions and credits before deadlines approach.

Can self-employed individuals claim both home office and vehicle deductions?

Self-employed individuals may claim both deductions if they meet IRS requirements. They must keep accurate records for each expense.

How does bunching deductions work for families?

Families group deductible expenses into one year.

This strategy helps them exceed the standard deduction and increase tax savings.

Conclusion

In this blog post, we’ve explored key tax strategies and effective approaches for optimizing your finances during the third quarter. As you navigate the complexities of tax planning, remember that strategic adjustments can lead to significant benefits. Now is the perfect time to evaluate your current tax strategies and make the necessary adjustments to ensure a smoother financial journey. We invite you to take action by consulting with a tax professional or utilizing high-quality educational resources to enhance your understanding. By doing so, you can position yourself for greater success and savings. Don’t miss the opportunity to optimize your tax approach today and reap the rewards.